Tax depreciation

What is Tax Depreciation?

Tax Depreciation Schedules assist you in claiming depreciation against your taxable income on your newly acquired investment property. Having this comprehensive tax depreciation report outlining the deductions helps you figure out what you can claim.

Capital works deductions

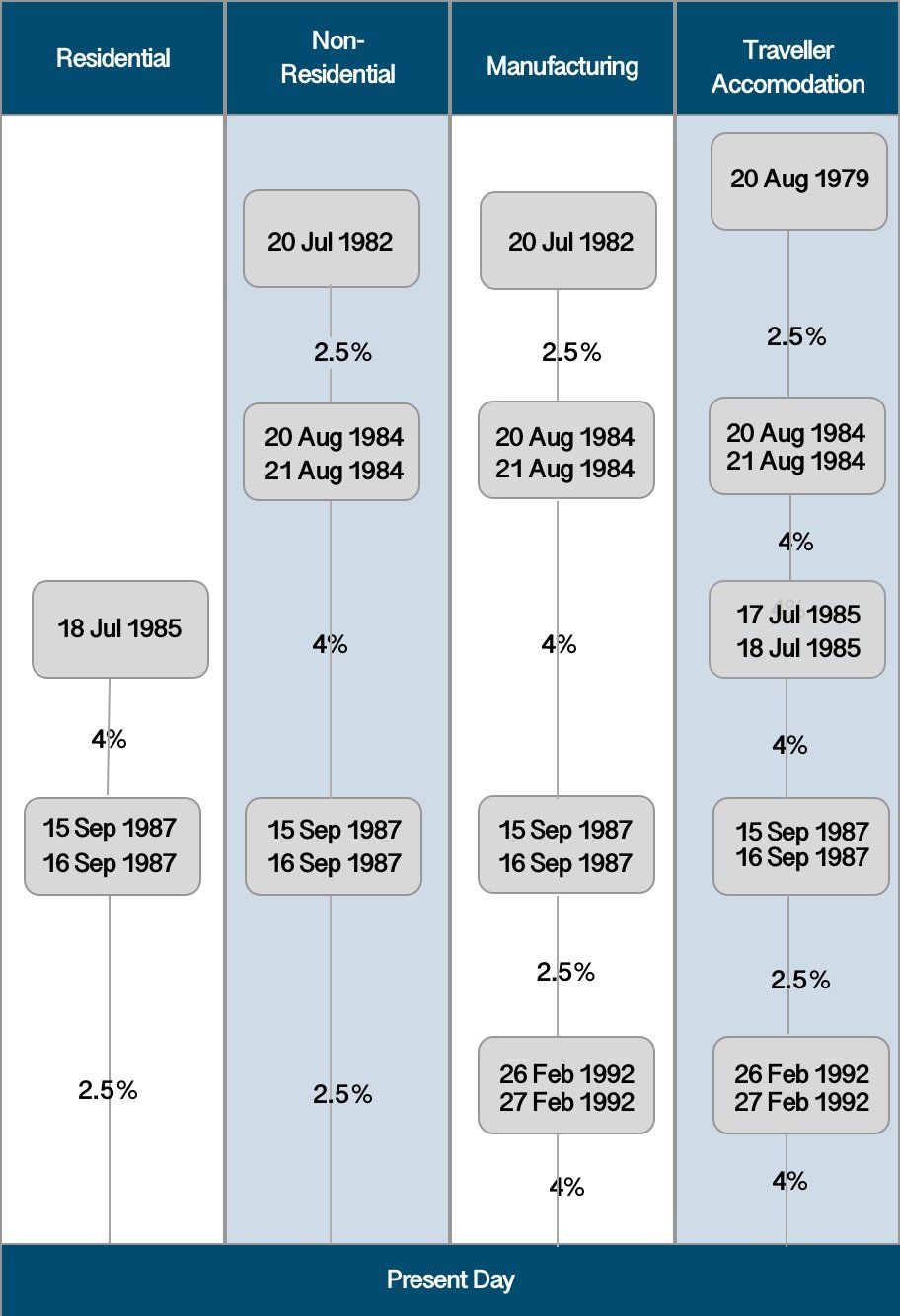

Capital Works Deductions (division 43) is commonly referred to as the deduction on the bricks and mortar. This is also referring to the structure of the building and items such as concrete, brickwork and roofing. These items are permanently fixed to the property and an investor can claim tax deductions for the wear and tear of the structure of the property. The deductions are based on the original cost of construction and the construction commencement date.

Plant and equipment depreciation

Plant and Equipment assets (division 40) is generally a tangible item which has a shorter lifespan. These items are easily detachable and replaceable from the property attracting higher rates of depreciation. Plant and Equipment assets have a limited practical lifespan, such as blinds, air conditioning, dishwasher etc.